March 10, 2022

Zeina Fawaz and Fara Elizalde join the rapidly growing Family Office

Roseville, CA – DCA Partners (“DCA”), a diversified financial services firm, is pleased to announce the addition of two additional executives to its Family Office group. DCA Partners Family Office is actively working to acquire over $2 billion of income-producing assets on behalf of its clients in 2022, and these new roles being filled by Zeina and Fara will be key to accomplishing this objective.

Zeina Fawaz serves as DCA’s Director of Investment Underwriting. In this role, she focuses primarily on selecting new opportunities to evaluate, investment underwriting, and overseeing the due diligence and closing processes for commercial real estate transactions across a breadth of asset classes.

Prior to joining DCA, Zeina was part of JLL’s Capital Markets division in Boston where she focused on property acquisitions, dispositions, and debt and equity placements for real estate investments and new developments. She has also worked at HVS, a hospitality appraisals company, where she performed sophisticated consulting and valuation work for existing and proposed hotels and resorts nationally.

“Zeina has already made significant contributions to our processes, operating discipline, and investment strategy,” commented Curt Rocca, Managing Partner at DCA. “She has an acute aptitude for finance, analysis, and investment risk, which will further enhance our ability to close high-quality transactions for our clients.”

Fara Elizalde joins DCA as a Contracts Manager. In this role, her primary responsibility is to serve as the liaison between external General Partner sponsors with whom DCA partners, and external legal, due diligence, lending, and other professional service providers. Given the volume and velocity of transactions which DCA plans to close this year, Fara’s role is imperative to ensuring all transactions proceed as efficiently as possible.

Fara holds a Master of Business Administration in addition to a paralegal certificate. She has spent the majority of her career in the human resources and legal fields, primarily within the technology and behavioral health industries. Most recently, she served as Director of Human Resources for Mindful Health Solutions headquartered in San Francisco.

“Fara’s organizational skills, keen attention to detail, and commitment to excellence have already earned her colleagues’ respect and confidence,” said Rocca. “Thanks to Fara’s skills and experience, we are able to close transactions faster, more efficiently, and with greater confidence than ever before. She has been a real asset to the team—not just for DCA, but also to the GP Sponsors we work with.”

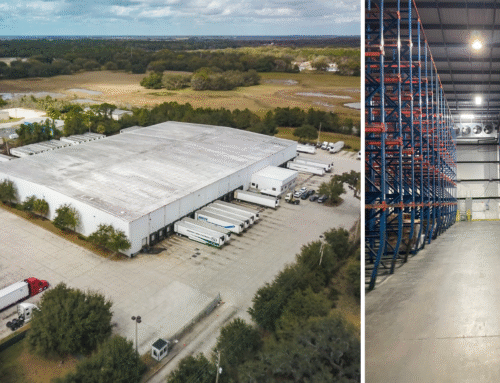

DCA Partners Family Office invests in partnership with top-tier General Partner Sponsors across a broad array of private equity, private real assets, and other alternative asset classes. In 2022, the firm is primarily focused on Multi-Family, Cold Storage, Data Center, Equipment, Transportation, Infrastructure, Car Wash, Hospitality and Agriculture investments. For more information about DCA, visit dcapartners.com.

###

About DCA Partners

DCA Partners is the region’s leading Merger and Acquisition (M&A) advisory firm. DCA also operates a series of Private Equity funds which provide growth and buyout capital to promising, growth-oriented businesses throughout the Western U.S. In addition, DCA has recently launched a Family Office investment platform which provides institutional-quality capital to talented real estate and other GP Sponsors delivered through a friendly, flexible, and collaborative Family Office platform. Through this platform, DCA is actively working to acquire over $2.0 billion of income-producing assets during 2022. Typical equity checks range from $20 million to $100 million.

Contact

Amanda Schroeder

Director of Marketing

DCA Partners

aschroeder@dcapartners.com